Our media, and even our schools, do a really poor job of explaining economics.

Over the years, I’ve read a fair amount of economics, and one thing that stood out to me from the start is that our press doesn’t present economics very well at all; not even on the “money” networks. Actually, especially not on the “money” networks. Most of what we’re told and taught about economics revolves around the stock markets. Well, nationwide, only about half of us own any stocks. Even crazier than that, the wealthiest 20% in this country own 92% of all stocks as of 2013! So, when it comes to economics, how much of an indicator are the stock markets, really? From Barack Obama’s Inauguration Day in 2009, to the end of his presidency, the Dow Jones Industrial Average went from 7949.09 to 19742.58. That’s an increase of 248%!

So, let me ask you this: Were you worth 248% more money at the end of Barack Obama’s presidency than you were at the beginning? Or were you making 248% higher wages at the end of his presidency than you were at the beginning?

My bet is that the answer to both of those questions is “no.” So, why do we focus on the stock market whenever we talk about economics? Because Wall Street pays the bills at CNN, CNBC, Fox News (and Fox Business), Bloomberg, etc. That’s why. Plus, it’s simply an easy way for the Democrats to put a feather in their cap and talk about some of the “successes” of the Obama Administration.

In truth, we pay that $240 million (many times over) through our medical care, which they use to turn around and influence congress to make sure we have no choice but to keep paying, or die.

Here’s what I’ve come to learn about economics:

When the press talks about the “free market,” they almost always define it wrong. So do our politicians. The thing is, we are the market. Businesses are the marketplace, but we are the market. When someone talks about how Steve Jobs at Apple “discovered a market for smart phones,” the “market” is us. He discovered that there are a lot of people who love to have information and communication in their pockets. What he didn’t do is create a market for smart phones. He couldn’t have. Think about it like drilling a well: You can tap into a water supply, but you can’t create one. It’s the same thing with markets.

The easiest way I’ve found to visualize the marketplace and the market is to imagine a shopping mall, like the Brea Mall: The businesses (stores) are the marketplace, and the customers are the market.

So, when the press, or politicians, talk about how we need to keep government regulation of businesses to a minimum in order to “keep the market free,” they’re not talking about the market. They’re talking about the marketplace. They’re misusing the term “free market.” What they’re usually referencing is an economic principle known as “laissez-faire.”

But a “free market” in economic terms is exactly what it sounds like in plain English: It’s a group of people (market) that is free. That means that a “free market” is a market where, first and foremost, the people can enter or leave the market at will.

The market for televisions is a perfect example of a free market. Television isn’t necessary to live, so most of us can enter or leave that market whenever we want. If prices are too high, or quality is too low, we simply don’t spend our money there. And when we do spend our money on a TV, we’re happy to do it, because we find a TV that we like at a price that we are willing to pay for it, and we happily exchange the money for the television. That’s the “free market.” Money spent in a free market is always voluntary. And because the marketplace (the TV manufacturers and retailers) have to compete against each other for our money, and because we also can tell them “no thanks” and not buy anything from them at all, these companies are continually building better and better products for less and less money. They have to in order to earn our money. This is how a “free market” economy operates.

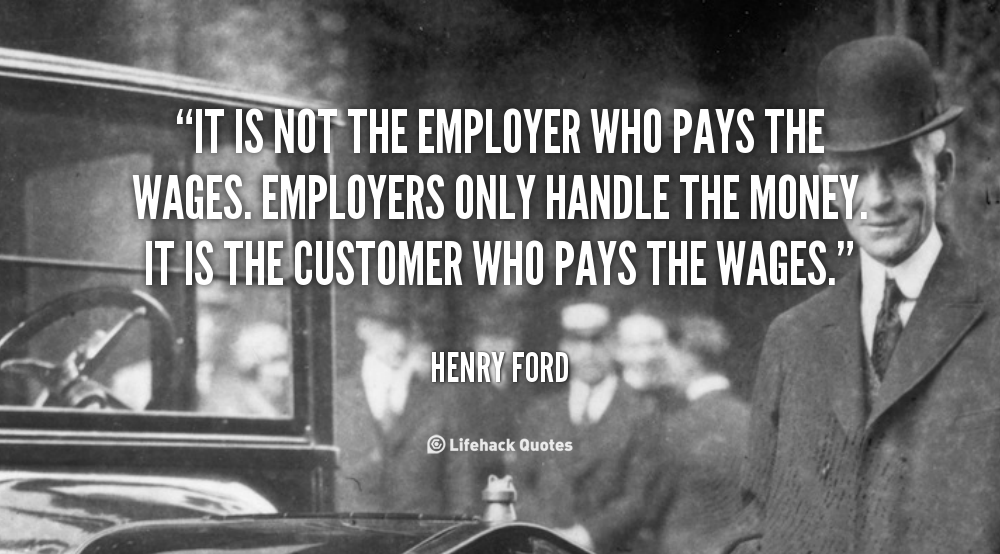

Henry Ford understood economics pretty well... His successors at his company, not so much.

The problem comes when we’re dealing with a monopoly (where one company controls enough of a marketplace that they can determine prices for everybody else), a captive market (where the market is not free to enter or leave the marketplace at will), or collusion (where companies work together to fix prices or product quality). Healthcare in our country is a good example of all three of those things.

In true, free-market capitalism, it takes a lot of hard work and dedication to turn a profit, but it’s well-deserved when you do. This is why so many business start-ups fail.

But in captive-market capitalism, it’s easy to make a profit. It couldn’t be much easier. And in truth, captive markets victimize free-market businesses as well, which means not only is making a profit easy in a captive market, captive markets make turning a profit much harder in the free markets as well.

That’s why I believe we need to control the captive markets in our economy, where necessities are sold to our people, but I don’t believe we need to put a lot of effort in regulating or controlling our free markets. As long as markets are free, they’re beneficial.